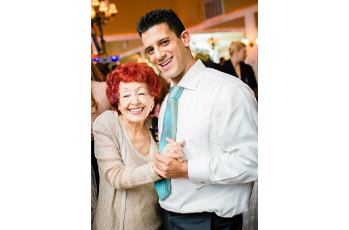

It’s a creepy picture, right? But a scary one if it happens to you.

When an elderly parent dies and leaves a will, it’s generally assumed that they were competent and of sound mind to make it. But there are several grounds for survivors may challenge the will. One is undue influence, which focuses on whether the deceased freely created and executed the will by their own choice. If a will come from undue influence, it is invalid.

Contesting a Will for Undue Influence.

Mental, moral, or physical exertion by one person over the testator can be undue influence. However, not just any pressure will be considered “undue.” Specifically, undue influence must “destroys the free will of the testator [maker of the will]” because it prevents the person from following their own thoughts or desires in the division of their assets. In other words, undue influence coerces the testator into giving away assets in a way that they would not have otherwise chosen. To amount to undue influence, this level of mental, moral, or physical exertion must be greater than mere persuasion or suggestion; instead, it must be so substantial that the testator would have been unable to resist the influence. In deciding whether a will came from undue influence, courts must carefully examine the specific nature and circumstances of each will through a case-by-case analysis.

Proving Undue Influence.

Proving undue influence can be difficult, especially because the testator is gone and cannot explain his or her intentions (recording that by video or audio can make a big difference). The person or persons challenging the will for undue influence must prove that the testator was influenced by the will’s proponent (aka the person who benefits from the will). To do so, the challenger must prove: (1) that a confidential relationship existed between the testator and the benefitted party; and (2) that there were suspicious circumstances surrounding the will. If these elements are proven, then undue influence is presumed and the will’s proponent then has the “burden of proof” to show there was no undue influence.

There is no definitive list of what qualifies as a “confidential relationship.” Generally, however, courts will presume that a confidential relationship exists when the testator was in a weakened position or was dependent on the alleged “influencer.” Also, certain relationships are inherently confidential, such as attorney-client, parent-child, or spousal relationships. “Suspicious circumstances” only requires slight proof to create a presumption of undue influence.

Ultimately, courts look to various factors in determining whether there was undue influence. Generally, these factors will include: the testator’s physical and mental condition compared to the proponent’s; the testator’s and the proponent’s temperaments; and the means of influence exerted. But, depending on the circumstances, factors will vary. For example, in New Jersey when the matter involves a married couple, courts look to factors specific to marriages. Such “marital” factors include: (1) the spouse’s control of the testamentary process; (2) the duration of the marriage, especially whether it was short; (3) the marriage’s foundation and whether it was financially motivated; and (4) the relative strength or weakness of the testator’s personality.

What has undue influence looked like in New Jersey?

Some circumstances in which New Jersey courts have found undue influence include the following.

- One court found undue influence where the testator, who was suffering from alcoholism, had become dependent on his second wife to manage his affairs. And additional evidence showed that the second wife deceptively convinced the testator that his daughters from his first marriage had stolen from him.

- Undue influence was found where an elderly widowed testator, while in the hospital awaiting surgery, revised her will to leave the majority of her estate to her neighbor, rather than to charities like all of her previous wills had provided. There, the neighbor had pressured her to sell her home to him, had distanced her from her longstanding attorney, and had provided her an attorney who was his personal friend.

- Another court found undue influence where a testator, while on hospice and dependent on his second wife, changed his will to leave everything to her instead of to his children from his first marriage as he had originally planned. Evidence also established that the second wife had written the revised will and drove him to the bank to have it notarized.

Claire Midili is a second-year law student at Seton Hall University School of Law, where she is an Associate Editor for the Law Review.